By Alan Pryor

The Davis City Council recently decided at their April 4, 2023 meeting that they would explore all options for putting a new general tax measure on the November 2024 ballot while declining to place a peripheral housing project on the same ballot. The Council’s stated reasons are that they did not believe Staff had the “bandwidth” to process both ballot measures simultaneously and that they feared the controversy of placing a peripheral ballot measure on the same ballot as their preferred general tax measure ballot may harm the tax measure’s chances of success.

And at last Tuesday night's Council meeting they agreed to relegate all future peripheral Measure J/R/D housing ballot measure to special elections over at least the next few years. I believe this decision was shortsighted and made without a complete understanding of what motivates Davis voters to approve or disapprove of tax measures in Davis.

Aside from the obvious charge that the City is favoring adding new revenue to their coffers over providing needed housing in the community (after standing on their soap boxes and proclaiming the dire need for housing over and over again in the past), this decision displays a misunderstanding of the realities of Davis electoral politics and this lack of awareness may presage the failure of both the expected November 2024 general tax measure AND any new peripheral housing ballot measure on later special election ballots.

Let me explain.

My Background in Davis Ballot Measure Elections

Firstly, before delving into the nuances of why I believe this decision by Council is fraught with danger with respect to obtaining passage of both a tax measure and a later peripheral housing ballot measure, it might be useful to readers to know of my experiences with ballot measure processes in Davis.

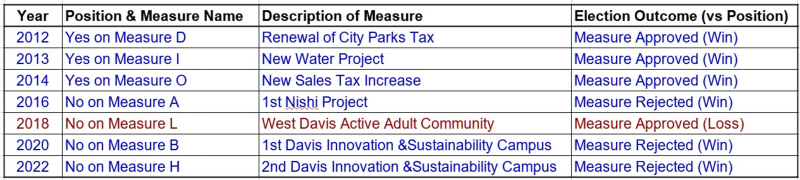

In fact, I have been very active in advocating for ballot tax and infrastructure measures and against peripheral housing measures in Davis elections over the past dozen years. Following are the Davis ballot measures for which I served as both Principal Officer and Treasurer in campaign committee filings with the Fair Political Practices Commission (FPPC):

But to be fair, while I served as both the Principal Officer and Treasurer for each of these each of these campaign committees, most of the campaigns had a dedicated cadre of citizens who also played instrumental roles in the campaign. In particular, current Mayor Will Arnold played a decisive role managing all voter outreach and communications during the Measure I campaign in support of the new Water Project. That ballot measure would almost certainly have gone down to defeat without his efforts. Large numbers of devoted citizens also played out-sized and instrumental roles in the Measure A, B, and H campaigns to defeat those peripheral projects. All of those ballot measures would have certainly had different outcomes had those many citizens not undertaken such key supporting roles in those campaigns.

The point I am making by disclosing my past electoral campaign involvements is that I believe it has given me a pretty good sense of the pulse of the community and what drives people to make decisions on municipal measures in the voting booth.

Why I Now Support Placing a Peripheral Housing Project on the Davis Ballot in November 2024

It is this understanding that has led me to the conclusion that the highest likelihood of success of both a tax measure and a peripheral development project is if they are both placed on the same November 2024 ballot instead of deferring placing a peripheral development measure on a special election ballot in 2025 or later.

Admittedly, some have find it surprising and have accused me of betraying the “progressive cause” because I am now advocating for placing at least one peripheral housing project on the ballot in November 2024 and stating that in doing so it increases its likelihood of success. I can appreciate why this has raised eyebrows and the ire by some in the community. After all, I have consistently opposed almost all such peripheral development projects in the past and have never actively advocated for any peripheral project to be placed on a ballot or supported such a project once it is on a ballot.

The reason I am now advocating for a peripheral housing project be placed on the ballot as soon as possible is simple, Times Have Changed!

As others have adequately noted and discussed, new state-mandates require cities to submit plans to the state’s Department of Housing and Community Development (HCD) that identify potential sites that can be developed for residential housing over the coming years. The stated goal of these mandates is to increase housing stock (particularly affordable housing) to substantially higher levels. Whether you agree with such mandates or not, until they are overturned by a court of law it is a reality with which all California cities must now address. If cities do not comply with these requirements by submitting plans accepted to HCD showing a pathway to increase their housing stock, the state may impose severe penalties including removing some control over local housing development from the local government. And they have already filed lawsuits against some communities for such failure to comply with these state mandates.

Such loss of local control opens the door to developers bypassing normal city control of housing project entitlement through, for example, imposition of the Builders’ Remedy. In addition, the state may also sue to remove local policies that they claim inhibit orderly mandated minimum levels of housing development. Davis has already had two submittals to HCD rejected for not meeting the minimum standards required for approval. While Staff claims they can rapidly rezone a number of properties within the City to come into HCD compliance, some observers otherwise feel this is wishful thinking on the City’s part particularly given the recent loss of proposed housing when the University Commons project was allowed to downsize from a multi-story mixed use housing and commercial development to a single story commercial only project; thus taking 100s of apartments out of the expected housing pipeline.

Should the City’s proposal to HCD continue to be rejected and eventually result in litigation against the City to impose more housing development, the obvious target of any such litigation likely would be to overturn the City’s voter-approved Measure J/R/D allowing citizens the right to vote on peripheral housing projects in Davis. I believe this to be a real and urgent concern. So to potentially save the authority of Davis voters to approve or deny future peripheral projects, I am advocating that the City place on the November 2024 ballot at least one of the currently proposed 4 larger peripheral projects now pending before the City.

Why Waiting to Place a Peripheral Housing Development Project on a Special Election Ballot after the November 2024 Ballot is Fraught with Risk of Failure

Others have opined, with reasons I functionally agree with, that placing a peripheral project on a special election ballot in the future may be “setting it up for failure” – see “Sunday Commentary: Staff Recommended Timeline Seems To Set Projects Up For Failure”. I will not belabor the reasons given in the article as readers can easily read it themselves. But suffice it to say that special elections are always low turn-out events and lead to ballot successes by those most able to energize their voters. This may not bode well when a majority of voters might be somewhat approving of a peripheral housing project but not sufficiently engaged to actually cast a ballot when they are otherwise not inclined to vote for other reasons.

Why Placing a General Tax Measure on the November 2024 Ballot without Coextensively Placing a Housing Development Project on the Same Ballot Probably Lessens the Likelihood of the Tax Measure Passing.

The most important aspect of securing the passage of a general tax measure is to gain the trust of the voters. The public must inherently trust that the City will spend the proceeds of the raised taxes responsibly. They must also be convinced that the City is operating efficiency and exercising spending restraint through cost cutting measures implemented by the City. And they must also trust that the City is also doing all it can to obtain the money it claims it needs through other means before going to the voters and asking them to open their wallets.

With respect to ensuring their citizens tax dollars are being spent responsibly, the easiest way to to clearly specify and commit for what the tax revenue will actually be used. This restricts how the money can be used and is generally required for parcel tax measures such as the City’s existing Parks Tax and the Open Space Tax.

Unfortunately, in this regard the City is at a distinct disadvantage because they are apparently opting to place a tax measure on the ballot as a general tax measure instead of as a parcel tax measure. Examples of a general tax measure would be an increase in the sales tax or a new utilities tax. However, a general tax measure cannot specify how the monies will be spent which in itself places a much greater burden on the taxing agency to convince voters they will be responsible stewards of their money in order to entice them to part with their money.

The reason Council is opting to place a general tax measure on the November 2024 ballot is simple and was clearly and openly discussed in the Council meeting on April 4th. That is, a general tax measure only needs to a simple majority to pass whereas Proposition 13 mandates parcel taxes need to pass with a two-thirds (66.67%) vote.

Toward that end, a great deal of discussion at the Council meeting was about how the Council can “engage” the public and convince them of the real financial needs of the City. When Public Comments were taken during this agenda item, I spoke of the even more critical need for the City to demonstrate to voters that they are exercising fiscal restraint and cost containment that almost every household in Davis does to balance their own budgets.

Unfortunately, in my opinion no such trust now exists on the part of the majority of the electorate in Davis. Many see their parks deteriorating and their streets crumbling compared to the level of infrastructure care seen in other nearby communities while hearing of extravagant spending on “nice to have” rather than “need to have” expenditures – e.g the $2,000,000 ladder fire truck purchase plus the million dollars to redesign/rebuild the downtown fire station to accommodate the larger truck plus the associated annual million dollar price tag for additional fire department personnel to operate the truck– and all the while the City otherwise would have continued access to UC Davis’s ladder fire truck only a few miles away.

The City will also have executed two new employee contracts with their labor unions between now and November 2024 and there is a high likelihood that annual employee raises granted though these new contracts will have already exceeded any amounts expected to be obtained through any general tax measure. It will be a difficult ask of voters to approve a new general tax increase if the Council has to explain to voters they have just granted annual increases in City employee salaries over the past 18 months that already exceed the amount of new monies raised through the tax increase.

To offset this perception of profligate spending on Council’s part, they really need to demonstrate that they are also very actively and aggressively seeking out new sources of revenue to supplement any proposed general tax increases. And probably the only way near term is to demonstrate this to voters is to place a peripheral housing project before the voters that could potentially generate tens of millions of new dollars in construction taxes and other fees – and at the same time addressing the perceived acute housing shortage in Davis and minimize the possibility of the City not reaching its state mandated housing goals as discussed above.

Can our City Council and Government Walk and Chew Gum at the Same Time?

This question was posed in comments to a recent editorial about the decisions facing the City Council over having both a tax measure and a peripheral housing measure on the same ballot in the November 2024 election. This was in response to the Council’s excuse stated on April 4th to justify not placing both measures on the same November 2024 ballot is that they did not think that Staff had the “bandwidth” to prepare and process both ballot measures at the same time. This is a disingenuous argument because completely different rank and file staff personnel are involved in preparing and processing each of the tax and peripheral housing project ballot measure.

For instance, preparing and processing a tax measure primarily involve the Finance Department at the City whereas preparing and processing a peripheral housing project ballot measure primarily involve the Planning Department. Of course there will be some overlap in required activities and the final authority for ensuring things are done correctly to properly get these measures on the ballot rests with the City Managers office. But I hope the Council is not really claiming that with an annual full-time employee count of over 300 employees at a total compensation cost to the City of well over $53,000,000 in 2021 (the last year for which I can obtain accurate figures), that the City does not have the resources to manage this process. Plus the City can also hire contract Planners to assist in processing routine building applications freeing senior Planning Dept Staff to concentrate on a large peripheral developments.

A Final Note: As stated by Mayor Will Arnold when discussing the basis for the decision to delay a vote on a peripheral housing project, he did not want to controversial housing measure on the ballot because it might compete with the voters attention and cast a shadow on the tax measure. Actually the converse is probably true. Having a local peripheral housing measure on the ballot would perhaps draw more attention away from the tax measure and lessen the public’s focus on the City’s fiscal operating shortcomings. The City otherwise just does not have a compelling story to highlight to voters as to why they need the money and how they would use it. It might not be a bad thing to draw attention away from this fact with a peripheral project ballot measure that sucks up all the electoral air.

In summary, I believe the Council’s decision to pull away from putting a peripheral housing measure on the same November 2024 ballot as their planned general tax measure was short-sighted and based on misunderstanding of how voters currently view Davis City government and their general wary and mistrustful mood.

Leave a comment