By Matt Williams

Over the last few weeks there has been a lot of discussion about Dan Carson's lawsuit over ballot statements that were alleged to be “objectively and verifiably false and/or misleading.” Honorary Campaign Chair Carson and the Yes on Measure H campaign team have had their day in court (pun intended), but it turns out that the language in the Ballot Arguments is just the tip of the “objectively and verifiably false and/or misleading” iceberg in the ongoing consideration by the voters of the DiSC 2022 proposal.

So, grab your Titanic deck chairs, and we will navigate some icy waters as the communications from the Yes On Measure H campaign team take you over, around and through their own “false and misleading” assertions about the benefit DJUSD will get from the DiSC project.

Our narrative starts in early March when Amy Haug, whose name is prominently featured on their website as a member of the Yes on H campaign team, contacted the leaders of the various PTA/PTO organizations conveying the following message:

I am not trying to bring this to you in a partisan way, just to bring information. I have already talked to the DHS PTA in the announcements part of their meeting and am scheduled to talk to Emerson, DaVinci and Harper this month. There is some really important things that parents should be aware of on the upcoming ballot measure. Here are just some of the benefits of the DISC for parents specifically:

- The developer has been negotiating with the school district and have agreed to a one-time donation of $2.3 million and a yearly donation of $700,000 every single year thereafter directly to the DJUSD.

To the credit of the leaders of the various DJUSD PTA/PTO organizations, they did some research on Measure H and determined that it does not have direct relevance to the mission and purpose of their respective PTA/PTO. As a result, they unscheduled the pending Yes On H presentations.

Before jumping forward from early March to early April, I ask you to take note of the words “negotiating” and “donation” in that Yes On Measure H message. Both the referenced $2.3 million and $700,000 are legally mandated fees/taxes/levies that all homeowners within the DJUSD boundaries pay each year in their Yolo County Tax Bill. I can not remember when any of those fees/taxes/levies were negotiable for any taxpayer … or could even vaguely be considered to be a “donation” to DJUSD. In fact, whether it was intentional or not, the use of the terms “negotiating” and “donation” is both false and misleading.

With that said, now let's fast forward to April 6th and the Yes On H presentation by Rick Gonzales and Dan Carson to the assembled members of the Davis Progressive Business exchange. To Rick and Dan’s credit the words "negotiating" and "donation" had disappeared from their presentation materials/handout and been replaced by the term "Impact Fees" together with the statement, “DISC will help generate $722,000 each year in perpetuity, which can cover facilities and programs (equivalent to the salaries of 10 new teachers).”

At the meeting I asked Rick and Dan to provide documentation of how/where the $722,000 was coming from, because there is no reference to it anywhere in either the baseline Features or the development Agreement. When I had not heard anything from either Rick or Dan for over a week, I contacted one of the City staff members I now, and they provided me with the calculations, which add up to $722,717.81. That total is made up of the following five components:

- $71,770.81 to pay the annual debt service on DJUSD’s General Obligation Bonds issued in 2000 after voter approval of a school facilities bond, Measure K on May 23, 2000, which enabled the District to complete basic repairs to education facilities

- $333,734.26 to pay the annual debt service on DJUSD’s General Obligation Bonds issued in 2018 after the voter approval of Measure M “to provide financing for the specific school facilities projects listed below in the Bond Project List”

- $122,268.20 from the Measure H eight year duration Education Programs Parcel Tax approved by the voters on November 8, 2016.

- $36,052.12 from the Measure G perpetual Employee Compensation Parcel Tax approved by the voters on March 3, 2020.

- $158,892.43 from the Facilities District Number 1 (CFD #1) approved by the voters on June 1, 1990 for the purpose of financing new and improved school facilities within the District. Although the bonds for CFD #1 are fully paid, DJUSD is continuing the annual CFD #1 tax assessment in perpetuity.

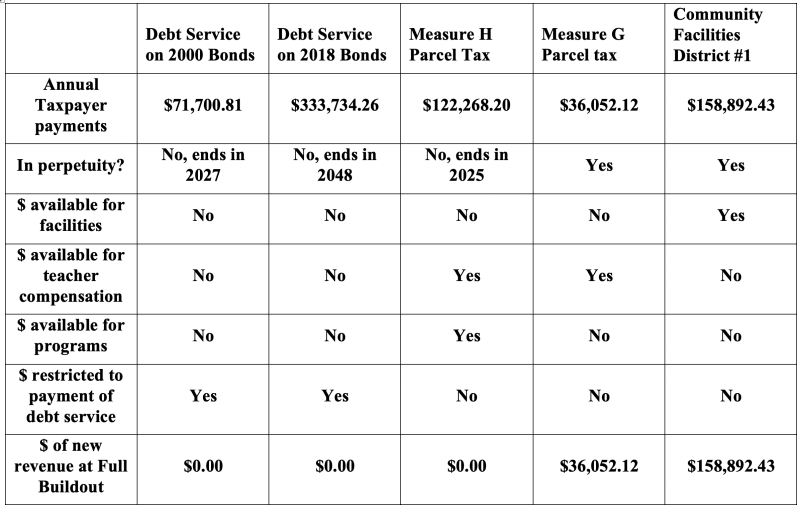

Armed with that information I created the following table that examines those five components in the context of the Yes On Measure H statement “DiSC will help generate $722,000 each year in perpetuity, which can cover facilities and programs (equivalent to the salaries of 10 new teachers).”

What does the above table tell us? At full buildout DiSC will generate no more than $194,944 in perpetuity which can cover facilities and employee compensation, but not programs (equivalent to the salaries of two and a half new teachers).

That, ladies and gentlemen, along with the aforementioned “donation” gaffe makes the DiSC team’s campaign statements “objectively and verifiably false and misleading”

Is it False or Misleading

when $722,000 turns out

to be only $195,000?

Leave a reply to Roberta L. Millstein Cancel reply