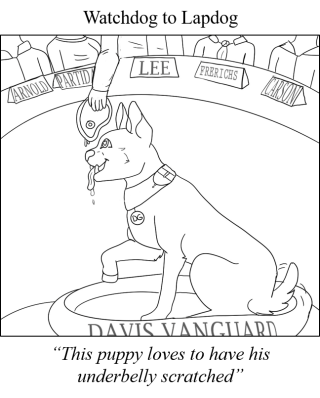

PART I: Vanguard Slams the Door on Required Public Disclosures

By Colin Walsh

On Friday, May 3rd, David Greenwald of the “The People’s Vanguard of Davis,” a 501(c)(3) tax-exempt company, refused to turn over nonprofit tax documentation. This appears to violate U.S Department of Treasury regulations and adopted Internal Revenue Service (IRS) guidelines. As stated on the IRS website [my emphasis]: “tax-exempt organizations must make available for public inspection certain annual returns and applications for exemption, and must provide copies of such returns and applications to individuals who request them. Copies usually must be provided immediately in the case of in-person requests, and within 30 days in the case of written requests.” The IRS website provides more detail about the types of documentation that 501c3 nonprofits like the Vanguard are required to provide.

On Friday afternoon at about 4:10PM, Rik Keller and I visited the Vanguard office, located on the second floor of 221 G Street in downtown Davis. David Greenwald opened the door shortly after Keller knocked. At first it looked as though Greenwald would invite us in as he has previous times I have visited the Vanguard offices, but as we stepped forward Greenwald moved to block the entrance.