Bill Gates would tell you we are in danger of living an impoverished life. The idea that we would have to give up our fossil fuel funding credit cards, it's just a bridge too far. Isn't it? It turns out that if you want to get your cash rewards, and stop funding fossil fuel banks with your credit cards, almost all of what you would get from a fancy frequent flyer credit card, you can get from a fossil funding free credit card from your local credit union or bank.

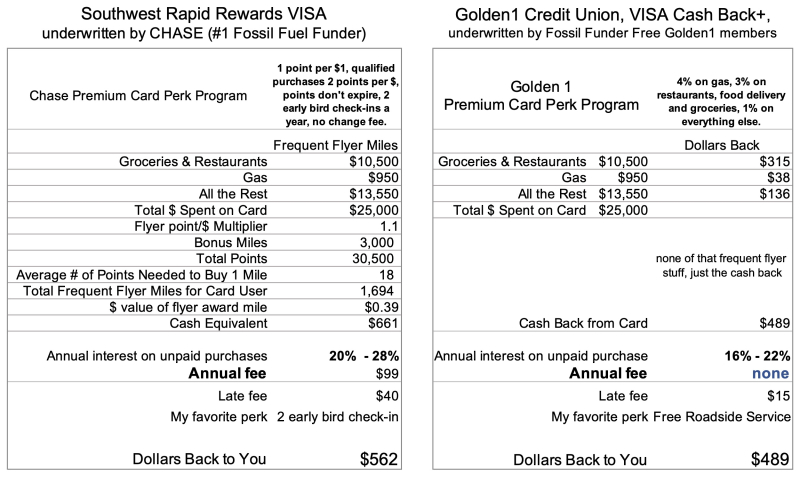

I have looked around. I looked at the comparison chart provided by ClimateAction, Compare Credit Card Table. The ClimateAction table does not include all choices. Golden One Credit Union Visa Cash Back+ card was not on the list, but I was encouraged to use the Credit Union for comparison as it had a lot of the features that were highest on the Fossil Funding Free card list.

I compared the Golden1 card to Chase bank's Southwest Rapid Rewards VISA card. Chase is the largest US funder of fossil fuel. My analysis shows that for $25,000 spent through the cards, you might lose about $73 (from $562 to $489) or a reduction of 12% cash back by going with the fossil funding free card. Based on this analysis, that's within the margin of error.

Today is TH!RD ACT Tuesday, if you're shopping downtown and you happen to notice a bunch of rabble rousers, of many ages, alongside Chase Bank, Bank of America, and Wells Fargo, you'll know why. Each of these banks uses record amounts of your deposits for their loans to oil companies around the world. They are the world’s largest funders of fossil fuel, and you're paying for them with the fees and interest syphoned from your cards..

You can change your credit card and you're not going to impoverish anyone. In fact, you're going to put cash in your pocket that is worth every penny of cash back that you get from your frequent flyer miles.